Level I of the

CFA® Exam

Video Lessons, Study Notes, Mock Exams and Question Bank

Highest-rated Question Bank among CFA® Program Candidates

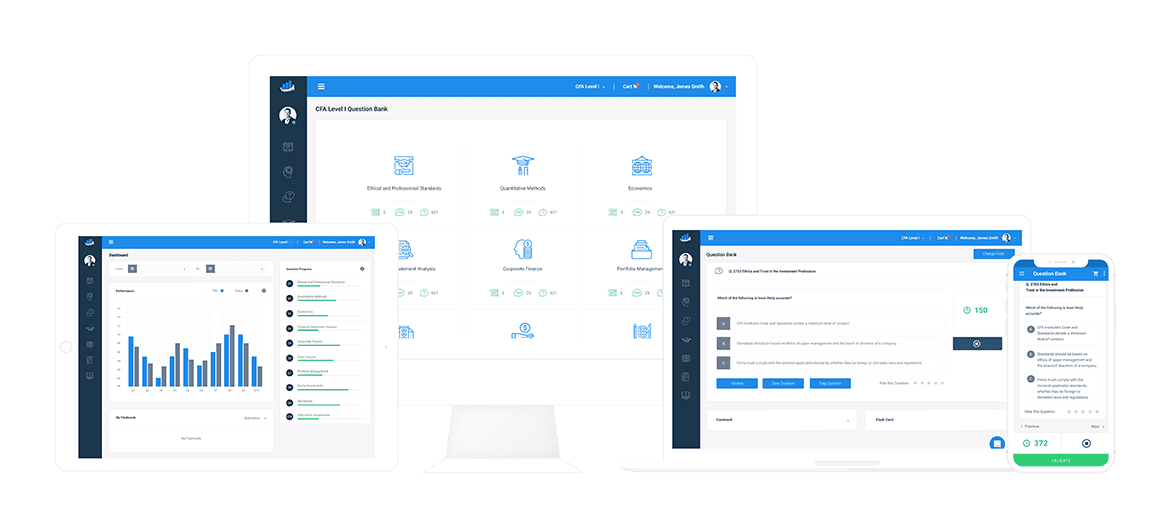

AnalystPrep's Preparation Platform for Level I of the CFA® Exam

What Should you Expect from Level I of the CFA® Exam?

The level I exam has 180 multiple-choice questions split between two 2-hour-and-15-minute sessions:

- Session 1 (morning): 90 questions covering ethical and professional standards, quantitative methods, economics, and financial reporting and analysis

- Session 2 (afternoon): 90 questions covering corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management

Both sessions must be attended.

Level I of the CFA exam is focused on acquiring basic knowledge of a wide range of financial issues. There are 10 topics categorized into 4 modules. These include ethics and professional standards, investment tools, asset classes, portfolio management, and wealth planning. Each topic has several learning outcome statements (LOSs) – equivalent to objectives – around which the exam is concentrated.

Each question is accompanied by 3 unique choices: A, B, and C. To make sure you attempt all questions, you should spend no more than 90 seconds (1.5 min) on each question.

Financial reporting and analysis, ethics, and quantitative analysis make up about 40% of the exam. If a candidate scores well in these topics, chances of success are quite high. However, we cannot emphasize enough the importance of covering every other topic. It’s the best way to prepare not just for the exam but also for levels II and III and your professional career itself.

| Topic | Percentage (%) | |

| 1 | Ethical and Professional Standards | 15-20 |

| 2 | Quantitative Methods | 8-12 |

| 3 | Economics | 8-12 |

| 4 | Financial Reporting and Analysis | 13-17 |

| 5 | Corporate Finance | 8-12 |

| 6 | Equity Investments | 10-12 |

| 7 | Fixed Income | 10-12 |

| 8 | Derivative Investments | 5-8 |

| 9 | Alternative Investments | 5-8 |

| 10 | Portfolio Management | 5-8 |

General Information about the Level I of the CFA® Exam

Before enrolling for Level I of the CFA exam, it is favorable for candidates to have general information about it. Since CFA Insitute operates globally, the exam is offered in 170 cities in June and over 70 cities in December. Candidates must have a good grasp of English as there is no other language option. The exam consists of 180 multiple-choice questions and has two two-hour-and-fifteen-minute sessions. There are 90 multiple choice questions in each session, and all topics are covered in each session. Test takers have, on average, 1.5 minutes to spend on each question, which can be a daunting task considering the amount of calculation some of the questions require. Questions have three answer choices, and there are two different question formats – sentence completing format and question format. All questions are weighted equally, and candidates are not penalized for taking random guesses. Topics covered in the exam include Ethical and Professional Standards, Quantitative Methods, Economics, Financial Reporting and Analysis, Corporate Finance, Portfolio Management, Equity, Fixed Income, Derivatives, and Alternative Investments. These topics are divided into 58 readings and take from 75 to 150 hours to read. This is one of the reasons why candidates often substitute the CFA Program curriculum for AnalystPrep’s Study Notes.

Exam fees for the Level I of the CFA® Exam

When the CFA Program is compared to MBA programs, it is much cheaper to get the CFA designation. Yet, candidates should still consider its fee before starting their journey into the CFA Program. The first fee that has to be paid to CFA Institute is the program enrollment fee. The program enrollment fee is USD 450, and it is paid when candidates register for Level I of the CFA Exam. This enrollment fee is a one-time fee. In addition to this, you should pay additional exam fees for each level. Besides, these exam fees can vary pursuant to the date of registration. If the registration occurs before 8-9 months from the exam, candidates will take advantage of the early registration fee of USD 700. In comparison, the standard registration fee is USD 1000 (3-4 months before the exam). In total, candidates have to allocate at least USD 1,150 for taking Level I of the CFA Exam.

CFA Exam Passing Scores & Pass Rates

Pass rates and passing scores are other important points that CFA Program candidates should consider. After the exam, the CFA Institute Board of Governors sets the minimum passing score for each level. The board assesses the passing score according to the difficulty of exams and demonstrated competency of candidates. Although it is possible to estimate the passing score based on previous results, passing scores are not announced by CFA Institute and cannot be known. Though, it is widely acknowledged that candidates who get more than 70% in general without getting less than 50% in Ethics can expect to pass the exam.

On the other hand, CFA Institute’s announced pass rates for the last three exams are around 43%. However, the pass rate is much lower for first-time exam takers and higher for those candidates retaking the exam for a second or third time. Compared to other levels of the CFA Program, level I has the lowest pass rates. Nonetheless, it is undeniable that the Level I exam is the easiest of the three levels. This contradiction stems from the gradual system of the CFA Program. Because previously successful Level I candidates will be taking Level II, Level II candidates have a higher probability of passing the exam regardless of the difficulty. The same holds for Level III, which has the highest pass rate.

How Many Hours Should You Devote?

One of the most common questions among candidates is how many hours a candidate must dedicate to pass Level I of the CFA Exam. Well, it is generally considered that candidates should devote more than 300 hours of study to pass each exam. Although this is reasonable for Levels 2 and 3, the situation is different for the Level 1 Exam. Level 1 focuses on basic finance knowledge regarding asset valuation, financial reporting, analysis, portfolio management, and simple analysis using investment tools. It is safe to say that candidates who have some basic knowledge of finance do not have to devote as much of their time as candidates new to finance. However, candidates with basic knowledge must not underestimate the exam. Even if it is a three multiple-choice exam and it may be sufficient to mark only 50% percent of the questions confidently to pass, unprepared candidates might fail if they do not devote enough of their time to understand the exam structure or solve a sufficient number of questions from a AnalystPrep’s Question Bank and Mock Exams. In addition to this, they may not have full knowledge of exam topics. To overcome this, they should allocate their time to not only solving questions and mock exams but also to studying exam curriculum where they feel incompetent.

Benefit of Study Materials Provided by Exam Preparation Platforms

Studying the CFA Program curriculum may be a grueling task for candidates. The curriculum contains numerous readings, and each of the readings has detailed explanations with extended examples. CFA Program study materials offered by AnalystPrep consist of study notes, question banks, and mock exams. The study notes are designed to summarize the CFA Program curriculum efficiently without leaving out any LOS as they shed light on the critical points. Question banks are based on subjects in the curriculum to help you assess your strengths and weaknesses. Mock exams are almost the same as the actual CFA exam in terms of format, difficulty, and length. Level I CFA Program candidates are usually not aware of how they can increase their probabilities of passing by using these study materials. First-time test takers might hear about these study materials, which would make their preparation much easier but do not feel the need to use them – which is a major mistake. The key to success in CFA exams is to repeat periodically what you have studied by solving at least 1,000 practice questions. Thanks to mock exams and question banks, candidates feel more confident as they can practice more test questions and mock exams compared to other candidates who only use the materials provided by CFA Institute.

FAQs about the Level I CFA Exam

| What are Level I of the CFA exam dates? | February, May, August, and November of every year starting in 2021 |

| What are the exam fees for Level I of the CFA exam? | USD 700 to USD 1000 plus a one-time USD 450 enrollment fee |

| What is the registration deadline for Level I of the CFA exam? | Early registration: 6 months to 4 months before exam time Standard registration: 4 months to 3 months before exam time |

| Which calculators are allowed? | BA II Plus (most common) or HPC 12C |

| How long is Level I of the CFA exam? | 4.5 hours, divided into two 2-hour-and-fifteen-minute sessions during the same day |

| What is the Level I pass rate? | Around 43% for the last year |

| What do I receive upon registration? | The CFA Program Curriculum (e-book version) and access to the CFA Program web platform. Even if you are not registered, you can also get free access to the Level I CFA Program Preparation Platform offered by AnalystPrep by clicking here. |

| What is the minimum passing score? | The minimum passing score (MPS) for each level of the exam is determined by CFA Institute each year after the administration of the exams. The MPS has never been released. |

| When will I know if I passed the exam? | 60 days after the exam |

AnalystPrep’s Level I of the CFA® Exam Study Tools

Compare Yourself to Other Candidates

The pass rate for Level I of the CFA exam has been averaging around 40% over the past ten years, which shows just how rigorous the exams can be. However, there is no limit on the number of times you can take the CFA exam nor the time in years within which you should complete the program.

AnalystPrep’s Preparation Platform includes an advanced built-in analytics software that allows you to keep track of your progress by monitoring your performance and comparing it to a class average. View your stats easily in attractive charts and quickly identify your strengths and weaknesses. Then, adapt your study method and improve your strategy in the areas that need more attention. Finally, compare your results with thousands of candidates who join AnalystPrep’s Prep Platform each year and stay motivated in your study sessions.

Questions Answered by our Users

Satisfied Customers

CFA PREPARATION PLATFORM BY REVIEW WEBSITES

CFA® Program

Level I Study Packages by AnalystPrep

Add video lessons and study notes for only $150 extra.

Combine all three levels, with lifetime access and unlimited ask-a-tutor questions for only $799.

Practice Package

$

349

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

Learn + Practice Package

$

499

/ 12-month access

- Question Bank

- CBT Mock Exams

- Performance Tracking Tools

- Video Lessons

- Study Notes

- Essential Review Summaries

Unlimited Package (All 3 Levels)

$

799

/ lifetime access

- Question Banks for all three Levels of the CFA Exam

- Mock Exams for all three Levels of the CFA Exam

- Performance Tracking Tools

- Video Lessons for all three Levels of the CFA Exam

- Study Notes for all three Levels of the CFA Exam

- Essential Review Summaries