AnalystPrep

FRM® Part II

FRM® Part II Study Materials and Question Bank

FRM Study Platform Trusted by Thousands of Candidates Each Year

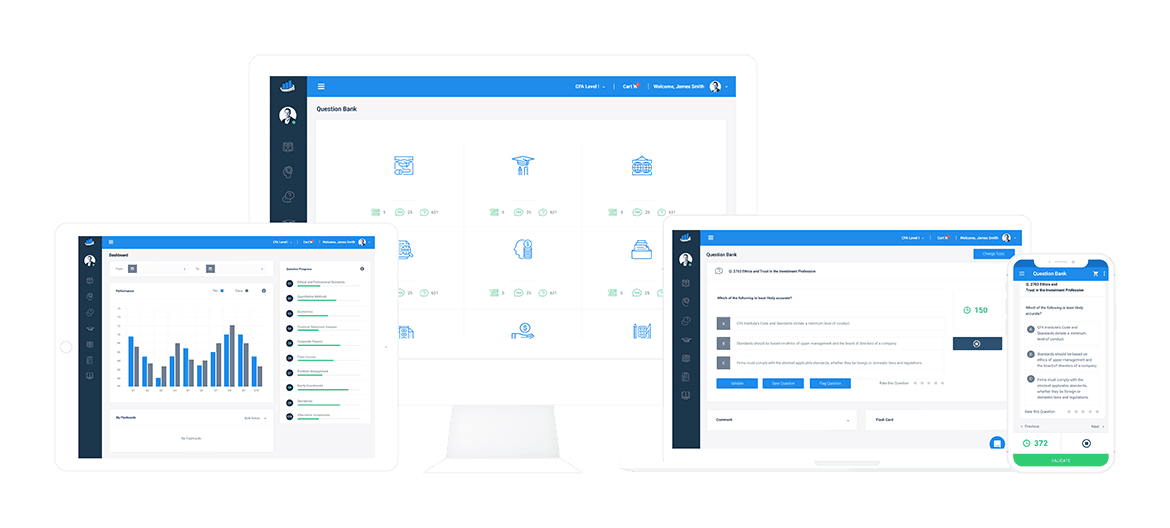

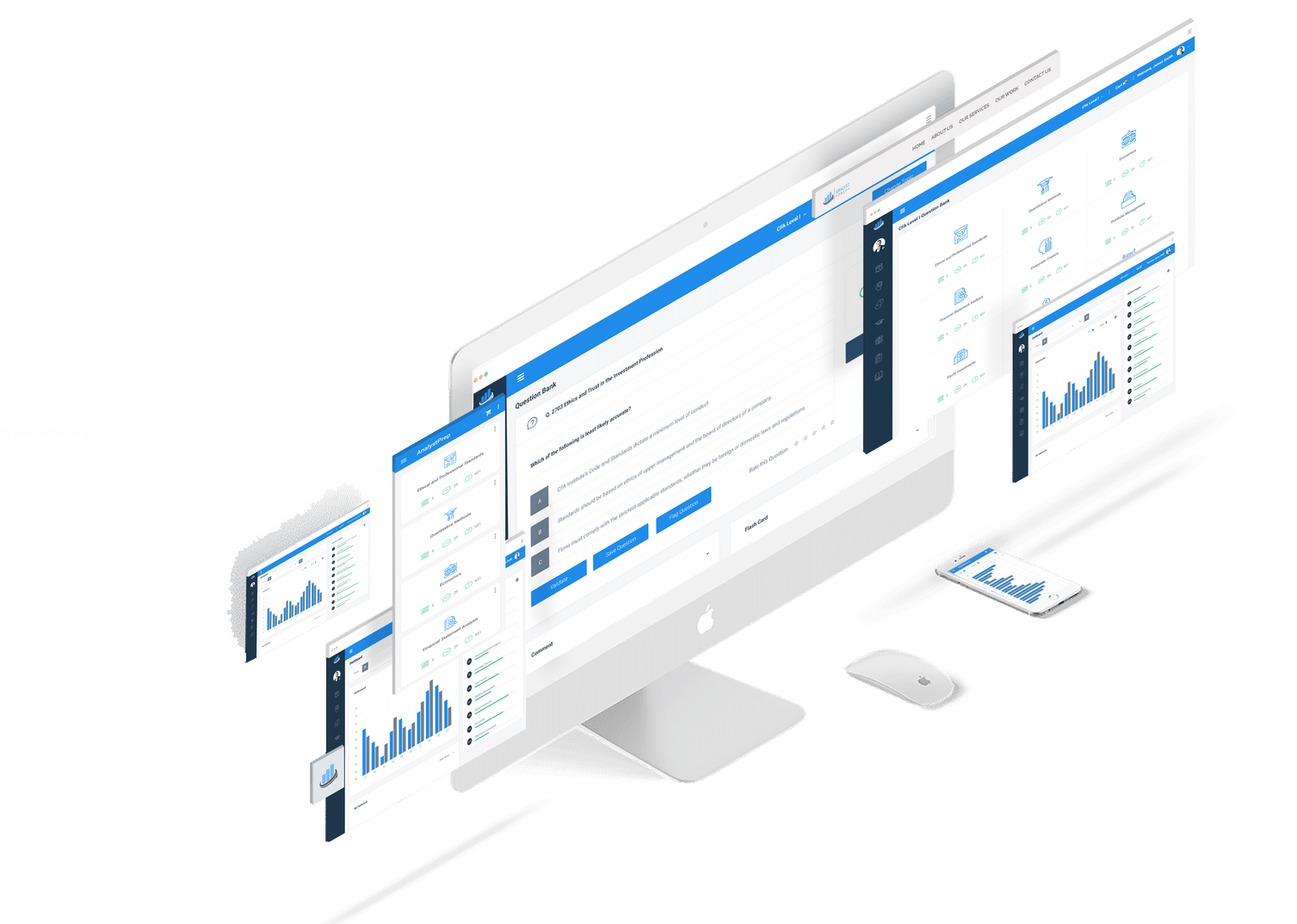

Our Platform

Study Materials for the FRM Part II Exam

Each FRM part 2 preparation package comes with access to our Question Bank, which contains over 1,500 hard practice questions to teach you all complicated aspects of risk management. To succeed in each area – market risk, credit risk, operational risk, and risk management in investment management – you will need to utilize a multitude of formulas to solve complicated risk management problems.

With AnalystPrep’s FRM Platform, you can create an unlimited number of Quizzes to test your comprehension of one or more areas of risk management simultaneously.

Finally, use our FRM Part II mock exams to test yourself in exam conditions and see if you can call back all relevant formulas for each topic. These practice tests – approved by the Global Association of Risk Professionals (GARP) – include 10% of questions on current issues in financial markets, just like in the actual FRM part II exam.

What Should you Expect from the FRM Part II Exam?

The FRM part II exam is broken down into five different general themes and are all assigned different percentages that factor into your overall grade:

- Market Risk Measurement and Management (20%)

- Credit Risk Measurement and Management (20%)

- Operational and Integrated Risk Management (20%)

- Liquidity and Treasury Risk Management and Measurement (15%)

- Risk Management in Investment Management (15%)

Current Issues in Financial Markets (10%)

Part 2 of the FRM exams will challenge you on 80 multiple choice questions and are offered on two dates in November and April. Pass rates for the FRM part 2 exam average around 50%, but keep in mind that half of the candidates have already failed part 1.

There are several key topics that should be emphasized throughout your study plan for FRM2. They include:

- VaR Mapping

- Volatility Smiles

- Spread Risk and Default Intensity Models

- Netting, Compression, Resets, and Termination Features

- Stress Testing Banks

- Basel II.5, Basel III and Other Post-Crisis Changes

- Alpha (and the Low-Risk Anomaly)

- Performing Due Diligence on Specific Managers and Funds

- Current Issues in Financial Markets

- etc.

In the exam, you have to understand the basics behind these theories and apply complex mathematical formulas to solve questions that are much more lengthy than in part 1. From candidates’ experience, the only way to get through is to practice, practice, and practice.

Questions Answered by our Users

Satisfied Customers

FRM preparation platform by review websites

FRM® Part 2 Packages

Our Learn + Practice packages include study notes and video lessons for $499.

Combine FRM Part I and FRM Part II Learn + Practice for $799. This package includes unlimited ask-a-tutor questions and lifetime access with curriculum updates.

FRM Part 2 Practice Package

$

349

/ 12-month access

- Question Bank (Part 2)

- Printable Mock Exams (Part 2)

- Formula Sheet (Part 2)

- Performance Tracking Tools

FRM Part 2 Learn + Practice Package

$

499

/ 12-month access

- Question Bank (Part 2)

- Printable Mock Exams (Part 2)

- Formula Sheet (Part 2)

- Performance Tracking Tools (Part 2)

- Video Lessons (Part 2)

- Study Notes (Part 2)

FRM Unlimited Package (Part 1 and Part 2)

$

799

/ lifetime access

- Question Bank (Parts 1 & 2)

- Printable Mock Exams (Parts 1 & 2)

- Formula Sheet (Parts 1 & 2)

- Performance Tracking Tools

- Video Lessons (Parts 1 & 2)

- Study Notes (Parts 1 & 2)